Creating compliant invoices is a critical aspect of running a successful business in Switzerland. Whether you are a small business owner, a freelancer, or an entrepreneur, understanding the requirements and best practices for invoicing can help you avoid legal pitfalls and ensure smooth financial operations. This guide will walk you through the essential elements of a Swiss invoice and introduce you to Magic Heidi, an online platform designed to streamline the invoicing process.

Essential Elements of a Swiss Invoice

To ensure compliance with Swiss regulations, an invoice must include specific details. Here are the mandatory elements that every Swiss invoice should contain:

1. Invoice Header

The header typically includes:

- Your Company Name and Logo: Clearly displayed at the top of the invoice.

- Your Address and Contact Information: Including email and phone number.

- The Client’s Information: The name and address of the recipient.

2. Invoice Number

Each invoice must have a unique identifier. This helps in tracking and auditing purposes. It’s best to use a sequential numbering system to avoid duplication and confusion.

3. Date of Issue

The date when the invoice is created. This is crucial for both accounting and tax purposes.

4. Description of Goods or Services

A detailed description of the products or services provided, including:

- Quantity and Unit Price: Clearly mention the quantity and the price per unit.

- Total Amount for Each Item: The total price for each line item, including any applicable discounts.

5. Payment Terms

Specify the payment terms, which include:

- Payment Due Date: The deadline by which the payment should be made.

- Accepted Payment Methods: Bank transfer, credit card, etc.

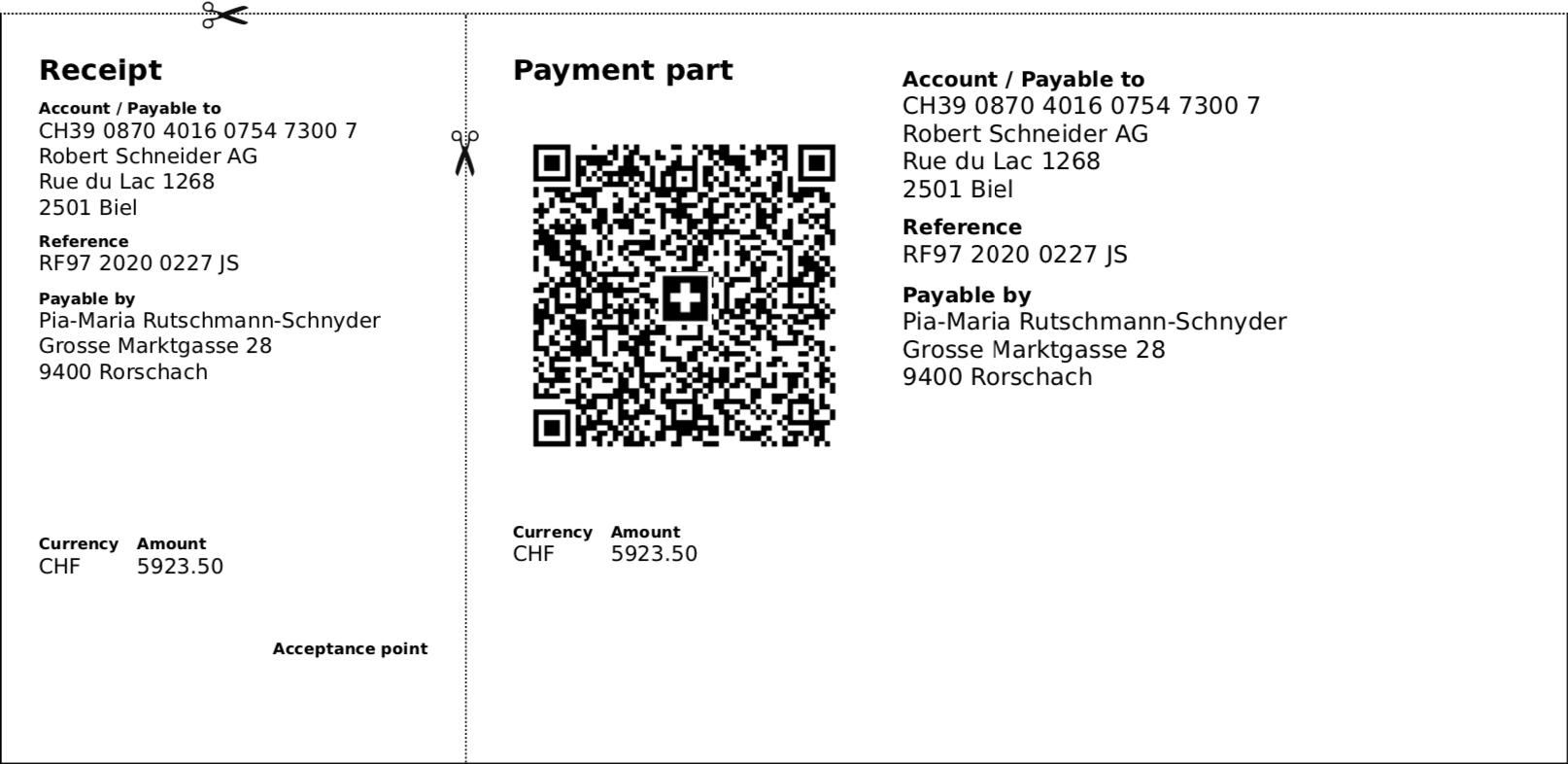

- Bank Details: Your bank account information for receiving payments.

6. Total Amount Due

Summarize the total amount payable, including:

- Subtotal: The sum of all line items before taxes.

- VAT (Mehrwertsteuer) Amount: Clearly state the VAT percentage and the amount.

- Grand Total: The final amount to be paid by the client.

7. VAT Information

If your business is VAT registered, include your VAT number and ensure the VAT amounts are clearly stated.

8. Additional Information

Any other relevant details such as terms and conditions, warranty information, or return policies.

Using Magic Heidi for Invoice Creation

Magic Heidi is an online platform that simplifies the invoicing process for businesses in Switzerland. Here’s how it can help you create professional and compliant invoices:

Streamlined Invoice Generation

Magic Heidi offers a user-friendly interface where you can easily input all the required information. The platform ensures that all essential elements are included, minimizing the risk of errors and non-compliance.

Customizable Templates

Choose from a variety of customizable invoice templates that suit your business branding. You can add your logo, choose colors that match your brand, and create a professional look for your invoices.

Automatic Numbering and Date Stamping

The platform automatically generates sequential invoice numbers and date stamps, ensuring your invoices are correctly documented and easy to track.

VAT Calculations

Magic Heidi automatically calculates the VAT for each invoice, based on the current Swiss tax rates. This feature ensures accuracy and saves time compared to manual calculations.

Secure Storage and Management

Store all your invoices securely in one place. Magic Heidi allows you to manage and track your invoices efficiently, making it easier to retrieve and review past invoices when needed.

Payment Integration

Integrate with various payment methods to offer your clients convenient options. Magic Heidi can include payment links in the invoices, making it easy for clients to pay directly online.

Getting Started with Magic Heidi

Step-by-Step Guide

- Sign Up and Set Up Your Account: Register on the Magic Heidi platform and fill in your business details.

- Choose a Template: Select and customize your preferred invoice template.

- Create an Invoice: Input the necessary information such as client details, item descriptions, and payment terms.

- Review and Send: Review the invoice for accuracy and completeness, then send it directly to your client through the platform.

Benefits of Using Magic Heidi

- Efficiency: Save time with automated processes.

- Compliance: Ensure all invoices meet Swiss legal requirements.

- Professionalism: Present a polished and professional image to your clients.

- Convenience: Access your invoices anytime, anywhere, from any device.

Conclusion

Creating compliant invoices is a fundamental part of business operations in Switzerland. By understanding the essential elements of a Swiss invoice and leveraging tools like Magic Heidi, entrepreneurs and small businesses can streamline their invoicing process, maintain compliance, and improve their financial management. Start using Magic Heidi today to experience the benefits of efficient and professional invoice generation.